Decrypting the Digital Economy: The Digital Alpha and Its Origins

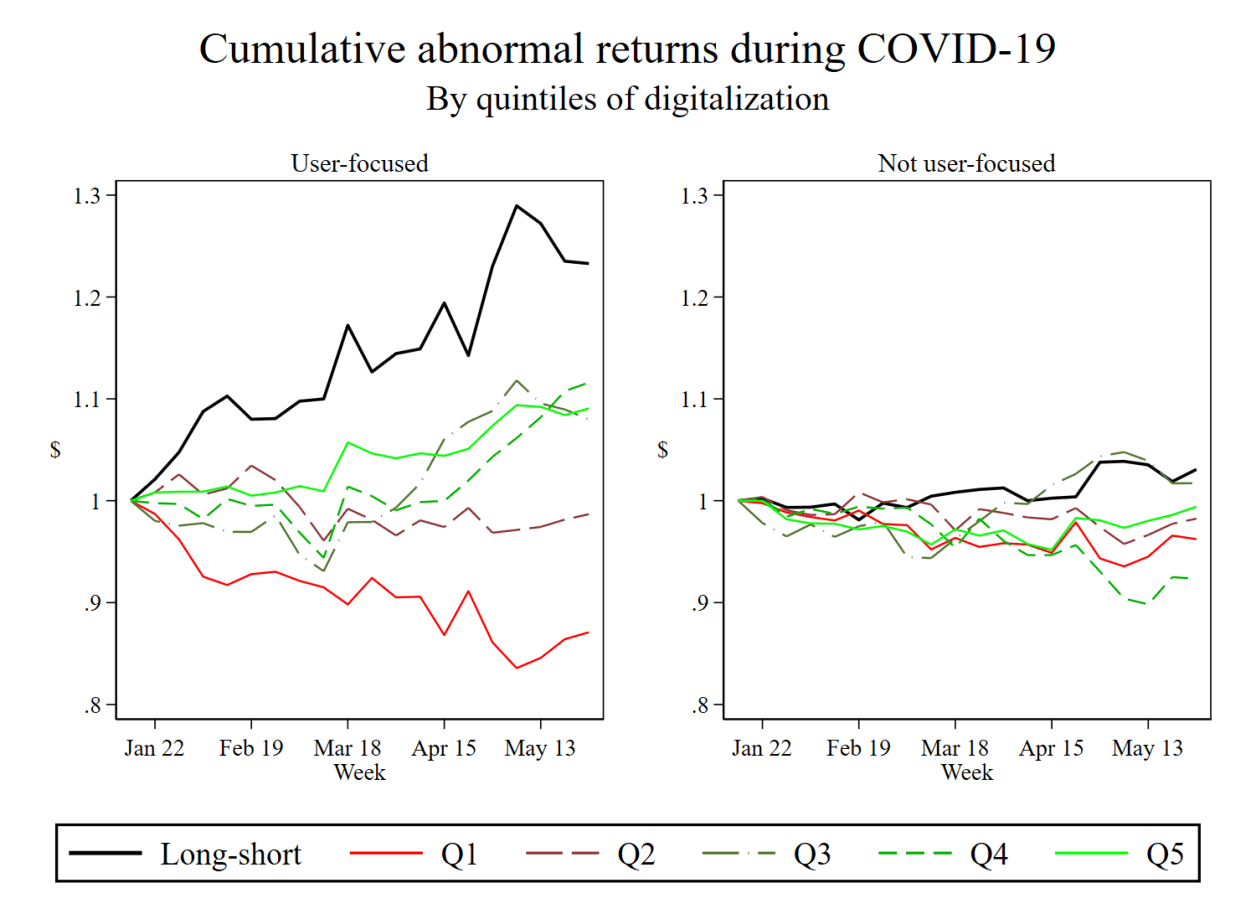

I study the stock market consequences of digitalization. I propose a novel dynamic measure of digitalization that holistically captures a firm's exposure to computers, data analytics, and programming. I find that digital firms, compared to non-digital firms, have annual realized excess returns which are 6.5% higher over the past two decades. This digital alpha does not appear to be explained by well-known stock return predictors nor firm characteristics. Instead, these excess returns are concentrated in firms which focus on users - where the alpha rises to 9.0% - and are consistent with a sociological and risk-based explanation.